The role of a merchant in an economy is critical. When you define merchant, it encompasses both individuals and companies engaged in trading goods and services. Merchants acquire products directly from manufacturers or wholesalers, create value through various means, and subsequently offer them to consumers.

There are numerous factors to consider if you aspire to become a successful merchant. Be it in brick-and-mortar stores or online platforms, strategies should be pursued to drive your business to the pinnacle of success. Here are some tips:

1. Understand Your Consumer:

The primary step towards success as a merchant is to comprehend your consumers’ needs and preferences. Regularly updating yourself with market trends will come in handy here. The objective is to provide goods and services which are in high demand to ensure a constant flow of consumers.

2. Develop Relationships:

As a merchant, establishing meaningful relationships with manufacturers, suppliers, and importantly, your consumers is a critical driver to success. This aids in creating a good reputation for the business.

3. Provide Excellent Services:

Providing exceptional services includes the quality of products, timely delivery, after-sales services, and customer relationship management, among others. This gains the trust of the consumers and boosts your business.

4. Adopt Advanced Payment Solutions:

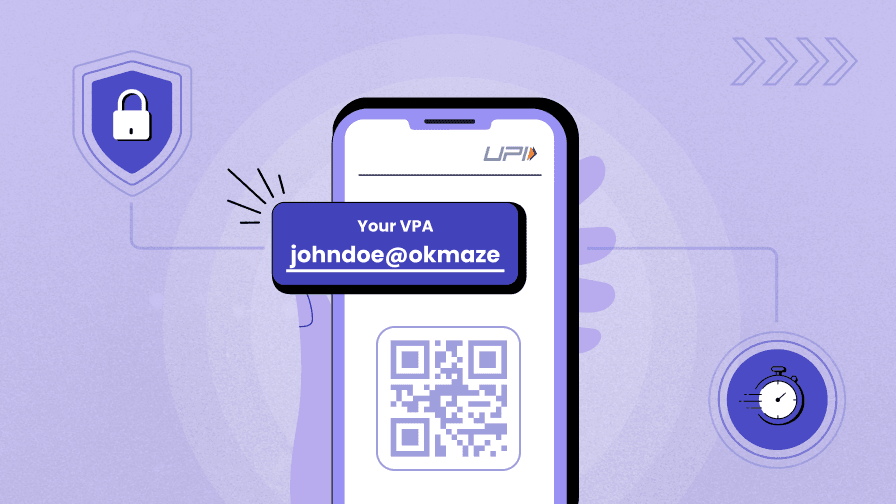

Today’s digital age has revolutionized the way business transactions are conducted with various digital payment tools like UPI (Unified Payment Interface). A common term you might come across while discussing UPI is ‘vpa full form’ or Virtual Payment Address. It’s a unique identifier that helps to transfer funds instantaneously.

One such player in the UPI market is Bajaj Pay. Bajaj Pay UPI has made transactions seamless and efficient for merchants. The platform offers various benefits including quick money transfer, compatibility with all banks, safe transactions, etc.

How to Use Bajaj Pay UPI:

Step 1: Download the Bajaj Finserv app from the Google Play Store or Apple Store.

Step 2: Open the app and register your Bajaj Pay UPI id (to register vpa full form mentioned earlier is used).

Step 3: Link your bank account(s) with Bajaj Pay UPI.

Step 4: To transact, either request money or pay by entering the recipient’s UPI ID/QR Code.

Step 5: Confirm your UPI pin to complete the transaction.

Remember, a successful conversion of a sale does not only involve selling a product or service. It includes getting paid on time, ensuring convenience and comfort to the customers. Here, Bajaj Pay UPI does the job effectively by empowering merchants to offer swift, secure, and convenient payment modes.

Remember, to define merchant is not just about the act of buying and selling. It involves creating successful sales strategies, satisfying customers, and adopting innovation. Keep up with the latest technologies like Bajaj Pay UPI to ensure hassle-free transactions. In this fast-paced marketplace, every aspect of the consumer experience, including payment, matters. For an aspiring merchant, it is critical to mould your business strategies to suit this ever-evolving environment, thereby ensuring success.

Conclusion

To conclude, the journey of being a successful merchant involves understanding the consumer, maintaining relations, providing excellent services, and keeping up with technology. Embrace the digital revolution and make the most out of platforms like Bajaj Pay UPI to make your journey successful and rewarding.